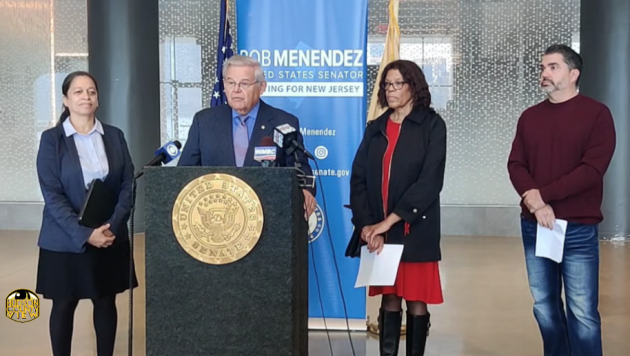

U.S. Senator Bob Menendez (D-NJ) joined with advocates and victims in calling on the owners of Zelle and the Consumer Financial Protection Bureau (CFPB) to do more to protect consumers.

By Daniel Ulloa/Hudson County View

Over the past several months, Menendez and several of his colleagues have led efforts to hold Zelle’s network operator, Early Warning Services, and the seven banks that own it accountable – which include Bank of America, Capital One, Chase, PNC Bank, Trust, U.S. Bank, and Wells Fargo.

“Hard working Americans are being cheated. The people behind Zelle are asleep at the wheel. In far too many cases, the big banks who own the app have denied their customers relief, knowing full well the scams are ravaging their customers. It must change,” Menendez said.

“When it comes to Zelle, the CFPB’s rules simply have not kept up with technology. Their regulations are woefully out of date. Alongside Senators Elizabeth Warren (D-MA) and Jack Reed (D-RI) I sent a letter to Early Warning Services, the ironically named parent company for Zelle which isn’t doing anything to warn consumers.”

Menendez continued that the CFPB are long overdue on taking action, noting that in 2020 more than 18 million Americans were defrauded through apps such as Zelle.

“It has an enormous impact on the financial well-being and lives of New Jerseyans and all Americans,” Financial Justice Organizer for New Jersey Citizen Action Beverly Brown Ruggia said.

She said initially online banking was lauded for its convenience.

“Yet banking this way has proven less safe for millions of customers who are preyed upon. They have made safe more conventional banking less available.”

She noted the rising cost of rent, gas, and food due to inflation, making it difficult for those who have been victims of fraud.

“It’s ironic the banking industry just joined a suit to weaken the authority of the Consumer Financial Protection Bureau at a time when we need more financial protections than ever,” Ruggia said.

“We join Senator Menendez in calling for Congress and the CFPB to strengthen the Electronic Funds and Transfer Act and to protect consumers who are defrauded by scammers.”

Alex Carrazana, from Westwood, said he tried to buy Buffalo Bills tickets for his son and his son’s friend through an individual he met on a Facebook page.

“I came across a Scott W. who had a couple tickets on sale. I negotiated a price for the deal. He actually said send it through Zelle,” he noted.

At first, he claimed there was a delay due to Ticketmaster but that turned out not to be the case.

“I sent him another message and it went unanswered. At that point, it looked like his profile had been deleted. I said ok, I’ve been scammed for about $600. So I contacted the Buffalo Bills Facebook page administrator,” Carrazana continued.

“The Buffalo fans were excellent. They tracked him and actually located him on other NFL fan pages trying the same scam. I reached out to Chase several times and got the same message. We can’t do anything about it and I should call Zelle. I called Zelle and couldn’t get ahold of a live person.”

Mary Powell, an East Orange residet, said she was scammed out of $3,500 and Wells Fargo didn’t do anything to help get her money back.

“The consumer can’t get anybody at Zelle and the bank says go to Zelle. They have to be transparent They should reimburse the individual so they are made whole on their platform because they have failed to meet their responsibility to the consumers,” Menendez explained.

“Believe me, if that were the case, they’d make it far better. They know these things are happening. They just choose not to do anything about it.”

in April and then again in July, Menendez led letters to Zelle’s parent company and the banks that own it – including J.P. Morgan, Chase & Co., Bank of America, and Wells Fargo – pressing them for do more to protect consumers from fraud and scams on Zelle.

That same month, Menendez led Senate colleagues in urging the CFPB to do more to protect consumers and hold banks accountable for fraud conducted using bank-owned instant digital payment networks like Zelle.

As a result, the senators called on the agency to update and clarify its rules and guidance for peer-to-peer payments regarding fraudulently induced transactions.