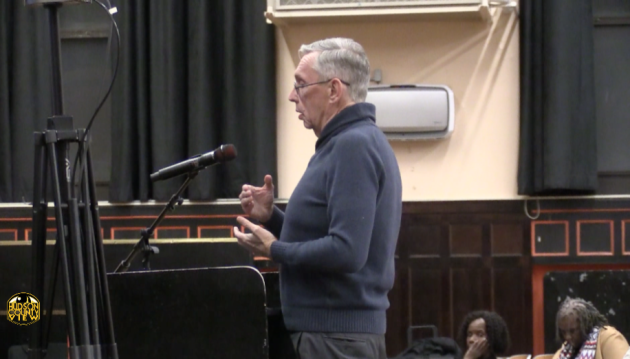

Hudson County Commissioner Bill O’Dea (D-2), a declared candidate for Jersey City mayor, is advising changes on collecting the payroll tax on construction projects.

By John Heinis/Hudson County View

By John Heinis/Hudson County View

“While I share the concern that businesses are not paying the taxes owed, the problem with collecting payroll taxes on construction projects is more severe,” said O’Dea, who got the city to investigate payroll taxes at 88 Regent St. about 14 months ago.

He added that around the same time, he raised questions about taxes never paid at a construction project on Grand Street.

“I still don’t know the disposition of that inquiry. There is an inherent flaw. The city has

almost no staff collecting the tax because they can’t recoup their costs!”

The former Ward B councilman continued that in conversations with the Jersey City Board of Education, they understand that reimbursing the city for more staff will result in a 10 to

20 fold return on monies collected, as he said at a public meeting in January.

“It’s even easier with construction projects to enforce collection, since the builder needs both a permit and a certificate of occupancy.”

Under O’Dea’s proposal, anyone who submits a permit application who is required to pay payroll taxes, must submit with the application an ‘estimate’ of their payroll tax liability.

The current municipal law would need to be amended so that no certificate of occupancy can be given until the builder/developer demonstrates that the payroll tax payment has been made.

Additionally, O’Dea argued, all subcontract agreements by builders must include a sign off that the sub is aware of the payroll tax law requirements and has received a copy of the law.

The building department would provide a copy of the law to anyone who picks up a permit application.

“With the construction boom we have lost and are losing tens of millions of dollars. The city should also immediately look at all certificate of occupancies given in the last three years for projects exceeding $10 million in cost and verify that payroll taxes were made.”

O’Dea reveals his plan after Ward E Councilman James Solomon, who has not announced his 2025 plans yet, revealed a proposal to The Jersey Journal for the city to collect on approximately $29 million local businesses own in payroll taxes.

The field of mayoral candidates for the non-partisan November 4th, 2025 contest also includes former Gov. Jim McGreevey, Council President Joyce Watterman, and ex-Board of Education President Mussab Ali, a political protege of O’Dea’s.

Solomon and Hudson County Commissioner Jerry Walker (D-3) are also potential mayoral hopefuls with incumbent Steven Fulop running for governor next year instead of seeking a fourth term.