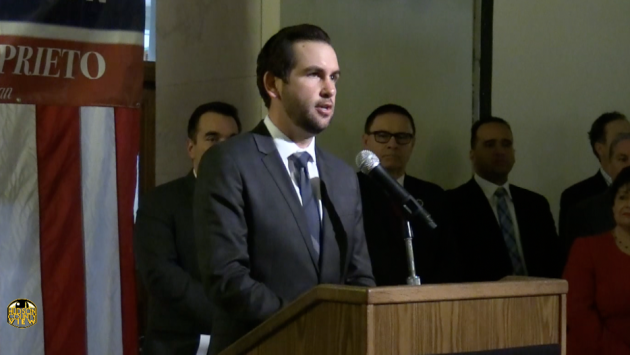

Jersey City Mayor Steven Fulop has signed an executive order giving 10 percent of future tax abatement revenue to the local public schools.

By John Heinis/Hudson County View

“For the past four years we worked on correcting the fiscal mismanagement and structural deficit that we inherited from past administrations, and were able to deliver four consecutive years of no tax increases and three consecutive credit upgrades,” said Fulop said in a statement.

“With the city’s fiscal house on solid footing, we believe now is the right time set the standard that tax abated properties contribute to the board of education to relieve the burden on all of our city taxpayers.”

The mayor further explained that the revenue would be shared through an unrestricted transfer of funds at the end of each calendar year, later adding that the success of Jersey City “can be seen in the growth of our school population.”

Tax abatements have been a hot button issue for the Fulop administration, a consistent talking point for critics which culminated in a mock celebration, led by former Board of Education Trustee Ellen Simon, of the 70th tax abatement approved by the council.

Simon and many others argued that 33 percent of the revenue from each payment in lieu of taxes (PILOT) agreement should go towards the Jersey City Public Schools District.

The administration analyzed a formula from Rutgers University that estimates the number of children expected per each PILOT high rise building, while also taking into account past examples in practice, the mayor’s office explained.

According to the high end of that projection, 25 percent of the units would send children to the school system, which is a very high estimate.

Using a formula that determines the amount of each abated project’s impact on city services, and factoring in 25 percent of the units using the schools, the city rounded upwards to 10 percent for the revenue to be shared with the public schools.

The executive order also includes revenue on tax abated commercial hotel properties, even though those buildings do not contribute to the school population or add to its operating costs.

“On behalf of the Jersey City Public Schools, I thank Mayor Fulop for continuing to work in the best interest of our children,” Jersey City Superintendent of Schools Dr. Marcia Lyles said in the same statement.

“We have seen tremendous growth and progress in our schools, and know this will continue that forward momentum.”

Speaking to Hudson County View over the phone, Jersey City Education Association President Ron Greco said this is a step in the right direction, but 10 percent is still not enough.

“I’m in agreement with Marcia Lyles that our staff and students will benefit from this economic boost and I’m glad to see that the mayor is acting in a responsible manner in helping to fund the school district,” stated Greco.

“However, this is a low ball figure, he should be requiring the developer to pay the full school tax that would’ve been picked up over the life of the abatement.”