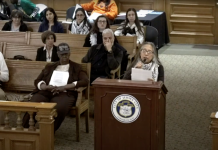

The Jersey City Council postponed the vote on a second reading of an ordinance to amend the city’s current rent control laws due to some key differences that exist between the versions introduced by the council and the administration.

By Marc Bussanich/Hudson County View

Ward E Councilman James Solomon made a motion to table the second reading ordinance because he explained that there had been no discussion of the ordinance in two previous caucus meetings.

In an interview, he explained that the council’s rent control committee, where he and Councilwoman-at-Large Joyce Watterman are co-chairs, have convened in hopes of ultimately rewriting the city’s entire current rent control ordinance.

However, Mayor Steven Fulop’s administration has put forth an ordinance that would only amend one section of the rent control ordinance that would eliminate an exemption for “newly constructed dwellings with 25 or more dwelling units located within a redevelopment area,” as only HCV reported.

“We haven’t gotten enough information from them about why it is they want this one change as opposed to the more comprehensive change that the city council is working on,” Solomon said.

“So we’re going to give it two weeks, get more information and then make a decision about whether it makes sense to move forward with this one ordinance or combine it with the overall efforts of the rent control committee.”

He explained that the difference between the two amendments is that the city is proposing the elimination of an exemption from rent control buildings in redevelopment areas so that buildings in redevelopment areas are subject to rent control after 30 years.

State law currently says that all new construction is exempt from rent control for 30 years, which the city cannot change.

Current city law, in contrast, exempts buildings in redevelopment zones from rent control after the 30 years expire.

“I think it (the city’s proposal) is a worthwhile proposal, but I want to consider it holistically because you can’t do one measure without considering the whole ordinance because there are so many provisions in the statute such as provisions around vacancy improvement, notification of tenants, how tenants exercise their rights,” Solomon added.

“We’re looking at it comprehensively, that’s how policy making in an ideal world should work.”

Solomon also said that the governing body is working on a measure that doesn’t necessarily extend rent control to all buildings within the city because the current law applies to buildings with four units or more built before 1987.

But one measure may include rent control to any buildings with four units or less.

The council approved the motion to table unanimously 8-0, with Ward F Councilman Jermaine Robinson absent for the vote.

The council also voted to table the first reading of ordinances that would approve a 30-year tax abatement for a developer that wants to rehabilitate four residential towers in Newport, which the administration has already asked the council to vote down.

Before the vote, Council President Rolando Lavarro said he’s looking forward to more discussion on the provisions but he wanted to make the council aware of a particular dilemma.

Lavarro said he is concerned that if they vote for the abatements at Newport, which the developer would add almost 30 new units of affordable housing, it’s possible that renters renting luxury apartments after the rehabilitation, would be paying rent control rates.

“I want to say that 80 percent of those units are market rate [and] those luxury units would potentially be subject to rent control. So we would essentially be giving rental control to renters in luxury apartments,” Lavarro explained.

“I don’t know that’s an outcome I’m looking to advance, although I do want to protect those [30] affordable units moving forward.”

What’s better than rent control? A tax on vacant lots and unoccupied buildings. While rent control makes it less attractive to supply accommodation, a vacant-property tax makes it less attractive NOT to! Â A vacant-property tax of $X/week makes it $X/week more expensive to fail to get a tenant, and thereby REDUCES, by $X/week, the minimum rent that will persuade the owner to accept a tenant.

Such a tax, although sometimes called a “vacancy tax”, is not limited to what real-estate agents call “vacancies” — that is, properties available for rent. It also applies to vacant lots and other properties that are not on the rental market, and is designed to push them onto the market and get them tenanted.

A vacant-property tax is intended to be avoided; if it’s properly designed, nobody actually has to pay it. And the *avoidance* of it would initiate economic activity, which would expand the bases of other taxes, allowing their rates to be reduced, so that the rest of us would pay LESS tax!