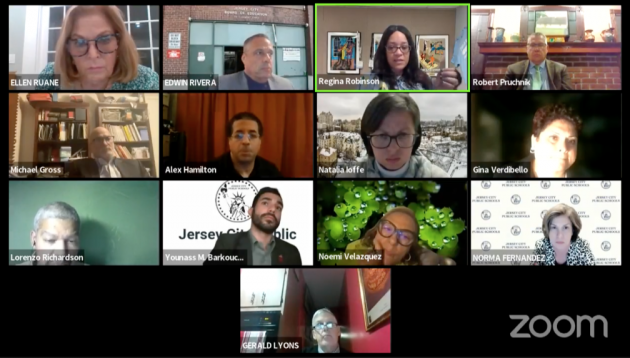

The Jersey City Board of Education pushed a vote on a $955 million budget that would come with a $2,400 annual tax increase per household at last night’s meeting.

By John Heinis/Hudson County View

“So what’s the scenario in using some of the bank cap in the sense of reducing the amount that taxpayers would have to pay. Obviously we’re not going to use the whole $185 [million] because I don’t want to deplete it completely,” noted Vice President Gina Verdibello.

“If we were to take half of that account, half of that 185, $93 million say, out of that bank cap, then that would reduce the monthly payments to $100 to a $460,000 home or $200 for a million dollar home, is that correct,” replied President Gerald Lyons.

School Business Administrator Regina Robinson said that while that was correct, the board still has the responsibility to submit a balanced budget to the county.

“On page 60 of your budget book, there is a few numbers on there. The first line talks about local tax levy. So the local tax levy, with a two percent increase on the local tax levy, is already account for at $283 million,” she explained.

“Our bank cap, if you look at the bank cap on page 68, that number is originally $538 million, we’ve already adjust from the levy of $283 [million] which leaves a net amount of $254 [million]. When you jump back to page 60, there is a $65 million line for the levy if you go all the way down to where it says ‘total revenues’ … it’s $570 million.”

She added that Acting Superintendent of Schools Dr. Norma Fernandez is asking for $184 million to cover the $754 million in budget expenditures.

The budget before the board is $955,647.335, a $141,595,627 increase from the 2021-2022 spending plan.

The board noted that few options exist outside of layoffs or cutting programs, particularly after another significant budget cut from the state to the tune of $68.5 million.

Fernandez was clear that she feels the budget should remain as is despite a less than ideal tax hike.

“What are your recommendations of places and things we could cut? Do we have any place to find money, Regina? I don’t think so,” she said to the board.

Verdibello and Trustee Noemi Velazquez both indicated they would support the budget in it’s current former, noting that it’s up to local officials to fully fund the schools regardless of what’s happening in Trenton.

Conversely, Trustees Alexander Hamilton and Younass Barkouch said the burden on taxpayers is too great in the current spending plan.

“There is no way we can tax our way out of this with these levy increases,” asserted Hamilton.

“I am responsible for students, not Jersey City residents, but to support these students, I must support these parents,” Barkouch said, also noting that lifelong residents shouldn’t have to take the make up the full difference.

When Trustee Lorenzo Richardson asked if anyone had suggestions on how to make up the financial woes, no one spoke for about 20 seconds before Trustee Lekendrick Shaw joked that it looked like they were playing Texas Hold ‘Em and suggested delaying the vote.

Ultimately, the board decided not to take any formal action after five hours of deliberations, with plans to convene again on Monday.

A preliminary spending plan must be approved by the county superintendent by March 28th before the board of education must okay a final budget a May.

A November directive from the U.S. Department of Education indicated the the district could recoup up to $126 million in state cuts in order for them to comply with the American Rescue Plan, but those funds have not been allocated yet.

The city has also said that they would not help make up the difference.

This is ridiculous that life long homeowners are taken on the taxes and all the New development is left out of paying taxes. Why are we not going after these developers that continue to build and not provide taxes. Make no sense that the residents that have own property in Jersey City for many years have to be responsible for all theses new developments tax burdens. The state won’t provide funds because you look at all the new development all throughout the city and see money should be here but it not because the Fulop and his cronies decided to sale the sole of the city for nothing.

This tax increase will help Mayor Fulop and his developers to remove the working and middle class from Jersey City.

Out with the old in with new and rich !