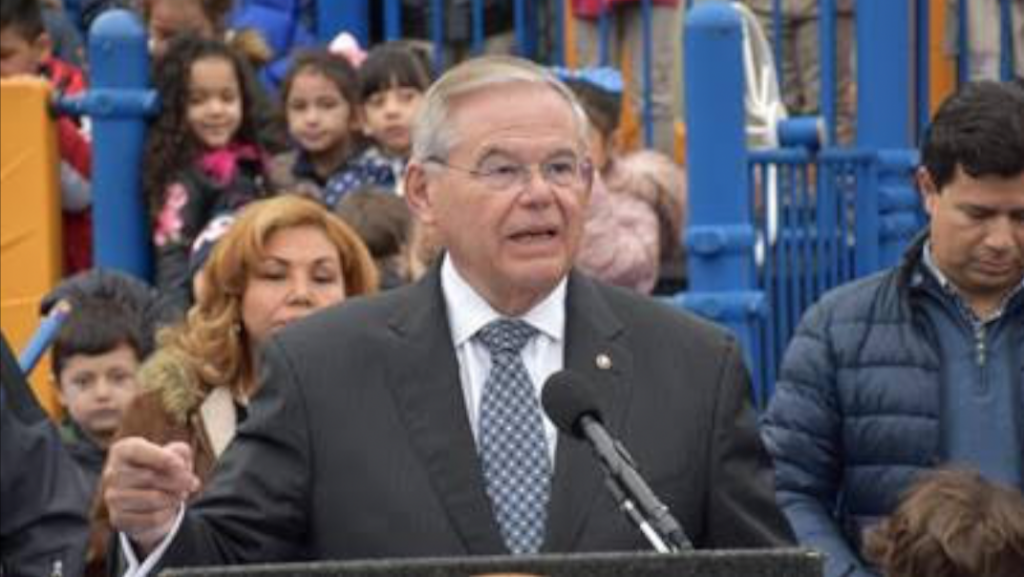

U.S. Senator Bob Menendez detailed some of the benefits of new legislation he is sponsoring, the American Family Act – which aims to aid low-income families – while at the Union City Day Care Center this morning.

By John Heinis/Hudson County View

“The American Family Act is the kind of bold action we need to give more low-income children, and especially children of color, a fighting chance of making it into the middle class,†Menendez said.

“Our legislation reforms the Child Tax Credit to reflect real-life challenges parents face. We know, for instance, that while the birth of a child is a joyous event, it’s also an expensive one and a leading reason why families fall into poverty.”

The legislation would be beneficial to families that earn less than $150,000 a year, allowing for a young child tax credit of up to $300 a month (for children under six), as well as a child tax credit not to exceed $250 a month (for children between ages six and 17).

Additionally, both benefits would be fully refundable if the new legislation were to take effect.

For example, a couple that earns a combined salary of under $150,000 year with two children under six can receive a maximum tax benefit of up to $4,000.

Under the American Family Act, that number would increase to $7,200.

As of this writing, the measure has been endorsed by the following organizations: Center for American Progress, Center on Budget and Policy Priorities, Center for Law and Social Policy, Child Care Aware of America, Children’s Defense Fund, Community Change Action, Economic Security Project, First Focus, MomsRising, National Association for the Education of Young Children, National Women’s Law Center, Niskanen Center, Service Employees International Union, and Zero to Three.