In an editorial, Sarah Levine and Julia Tache explain how Jersey City has left over $100 million for affordable housing on the table in the past decade.

By Sarah Levine and Julia Tache

Last October, the Jersey City Council belatedly approved the $724.8 million budget for 2022. The city missed a deadline that would have enabled it to collect an additional $10 million, an amount that was foisted onto taxpayers.

While a $10 million fumble is egregious, a larger financial failure looms: Jersey City continues to fail to harness all possible revenue streams at its disposal by refusing to collect fees on new development, a major loss for residents.

Every city in New Jersey is permitted to collect certain fees on new development, pursuant to the New Jersey Supreme Court’s decision in Holmdel Builders Association v. Holmdel and subsequent regulations by the now defunct Council on Affordable Housing (COAH).

Any city can collect fees on new residential developments up to 1.5% of the equalized assessed value of the development at the time a certificate of occupancy is granted.

If collected, these fees must be spent on affordable housing and similar initiatives. By failing to take advantage of this plainly legal revenue source, Jersey City neglected to collect over a hundred million dollars from developers over the past decade.

And the city’s failure to collect these millions for affordable housing coincides with the greatest housing crisis in the city’s history. In 2018, 7,100 evictions were filed in Jersey City, representing a higher rate than the national average.

Jersey City is now the most expensive city for renters in the country, and 71 percent of residents rent their homes. Members of lower income households struggle to pay rent as assistance from the CARES Act and other COVID-19 relief sources dry up.

We put together a study to quantify how much money the city could generate by claiming these fees. First, we pulled public data about recent residential development in Jersey City.

Then, we cross referenced data from the county tax assessor to identify the assessed value of each development granted a certificate of occupancy.

We then calculated the equalized assessed value (EAV) of the development based on state equalization tables. Finally, we applied a 1.5% fee to each development and added up the total. We shared our methodology and findings with local council members.

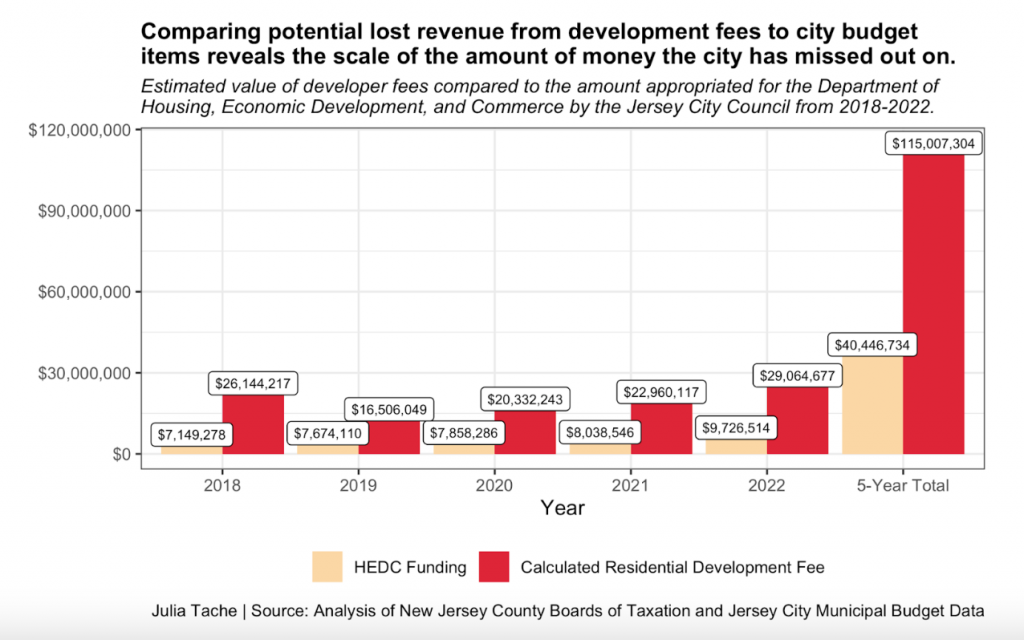

Based on conservative estimates, this study revealed that over the past five years (2018-2022), Jersey City has failed to collect nearly $100 million dollars in residential fees – $115,007,304.

That is nearly one-seventh of the total city budget that could be going towards housing justice measures.

To put this into perspective, the amount appropriated for city services through the Department of Housing, Economic Development, and Commerce during this period was $40.4 million, illustrated in the graph below.

Assuming developments were completed at a consistent rate throughout this period, we estimate that passing a development fee ordinance will generate close to $20 million annually.

In order to claim these residential fees, the city can pass local Ordinance 23-029 stating its intention to collect development impact fees, and then file a spending plan with the Superior Court detailing its intention to use the funds for affordable housing.

Dozens of municipalities across N.J. have already done this.

The council should also have an open dialogue with community members about where and how money should be allocated.

Further, New Jersey law permits 20% of these development fees to be used for “administrative” costs and programs, and we encourage Jersey City to think creatively about how to allocate funds.

A proposal to establish a Right to Counsel, conceived by local organizers, will be presented to the city council guaranteeing renters in Jersey City the right to an attorney when facing eviction.

This policy would hold developers accountable and require them to pay their fair share to fix the local housing crisis they have helped create.

Development companies are rapidly altering neighborhoods and charging rent far above what average Jersey City residents can pay, while failing to invest in local communities. Residential construction that occurs in our city must prioritize affordability and sustainability.

We urge Jersey City residents to reach out to your local council person and demand that they act immediately to begin collecting development fees to fund affordable housing, a right to counsel, and more. It is time to make developers pay their fair share.

Sarah M. Levine is a labor lawyer born and raised in Jersey City. Julia Tache is the Media and Communications Chair of the Right to Counsel Jersey City Campaign.

It is anything but “luxurious” to live in Jersey City: it is outrageously expensive, and now grossly overcrowded, we are losing diverse neighborhoods and quality of life issues are being ignored. We are in danger of losing the jewel of the city, Liberty State Park, to the highest bidder and the JC pols and boe don’t even bother to hide their corruption – they are never without a scheme to pull more and more money out of the pockets of taxpayers without giving anything back. Whenever fulop is called out for reneging in his promises to taxpayers, his mo is to throw someone else under the bus and then double down on his pet projects, of which affordable housing isn’t one of them. And that’s politics as usual in fulop’s JC. Remember that on election day and DO NOT vote fulop for governor and DO NOT elect any of his cronies to remain in office here in JC or the state of NJ as well.