West New York Mayor Gabriel Rodriguez is encouraging residents to apply for the ANCHOR property tax relief program, which is open until the end of the year.

By John Heinis/Hudson County View

“This is huge news for West New York that benefits homeowners and renters alike with significant relief that I hope and encourage our residents to take advantage of,” Rodriguez said in a statement.

“Our administration has held the line over the last four years while making significant investments in our infrastructure and streamlining government services – all while dealing with the unprecedented global pandemic – this news from the NJ Division of Taxation provides a glimpse of further relief for WNY residents and our neighbors across the State.”

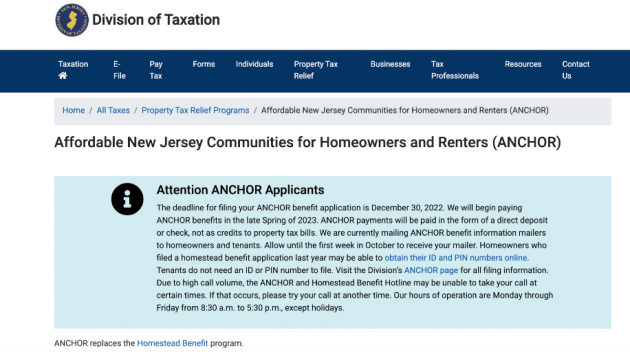

The ANCHOR program replaces the Homestead Benefit program and expands the amount of property tax relief while also boosting eligibility to twice as many homeowners, and also includes tenants renting their homes.

The Division will be emailing ANCHOR program filing information to homeowners who had requested their application be sent through email when they filed their 2018 Homestead Benefit application at the same time the physical mailers are sent out.

The NJ Division of Taxation mailers will begin arriving to tenants and homeowners in Hudson County on September 21st and the department has asked that residents not call about a missing mailer until at least two weeks after the expected delivery date.

To be eligible, homeowners must have been a New Jersey resident, owned and occupied a home in New Jersey that was their principal residence on October 1st, 2019, paid the 2019 property taxes on their main home, and not earned a gross income of more than $250,000 in 2019.

As for tenants, the requirements are nearly the same, though they must have lived in a unit with separate kitchen and bath facilities and paid rent at a facility that was subject to local property taxes.

They also could not have earned a gross income of more than $150,000 in 2019.

Applicants will choose to receive their benefits either as a check or direct deposit and must file their application by Friday, December 30th.

The online application, eligibility requirements, filing instructions, and paper applications can also be accessed at nj.gov/treasury/taxation/anchor.

The automated telephone filing system, which will be available 24 hours a day, seven days a week, during the filing period, can be reached at 1 (877) 658-2972.

Furthermore, a Text Telephone Service (TTY/TDD) for hearing-impaired users can be reached at 1 (800) 286-6613 or (609) 984-7300.