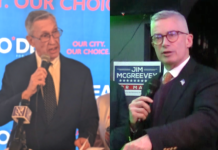

Jersey City Mayor Steven Fulop fielded numerous questions from concerned residents about the upcoming reval, some of whom feel they will be priced out from Jersey City completely.

[fve]https://www.youtube.com/watch?v=BUPXAFnlB1Y

[/fve]

Ward E Councilman James Solomon explained many of the details behind the mathematical formula that will be deployed to determine the difference between a property’s assessed value (as determined by local government) and real estate market value.

He utilized a PowerPoint presentation that revealed homeowners’ tax bills may go up from $10,000 in 2017 to $20,000 in 2019.

Solomon also wanted to make sure that residents understood exactly what a reval is.

“A revaluation is when the city looks at every single property, every single lot across the city. And it assigns them an assessed value, which tries to match the market value. The city is doing that for every property across the city,” said Solomon.

He dispelled the notion that the city will be receiving a windfall in extra money.

“I’d like to clear up a misconception. What’s happening is that revenue is getting redistributed across the city based on the value of residents’ properties. So some people’s [tax bills] are going up, some are staying the same, and many are going down,” Solomon said.

He then said that the appraisal company hired by the city will use a two-part process to determine the new assessed values, called an “Improvement Process,” i.e., the condition of the property and the value of the land.

After Solomon’s presentation, Fulop bore the brunt of resident’s questions and concerns that the newly assessed values will force them to leave Jersey City.

One resident told the mayor that she left Manhattan for more affordable prices in Jersey City, but now may have to move elsewhere if the assessed value is too high.

Fulop responded that he had fought the reval in his first term because he was concerned about residents being priced out.

“It’s a big concern for me who has been doing this for 12 years. I wish we could change the  system and wish you didn’t have this sort of increase today, but state law provides very little flexibility, virtually nothing of the [new assessed values],” the mayor said.

Mayor Fulop needs to work with the state on relativity factors for long term residents. The formulas may have made sense decades (i.e., before Wall Street was high flying) the formulas need to be normalized so that the residents of the community is not driven out. It would be advisable also to create a one-time adjustment for the inequities of the property taxes that has had long term resident carrying a disproportionate share of the tax load.

Long term residents are the ones who weren’t carrying the tax load. It’s been all the new construction in the last 20 years who are bearing the brunt of the taxes, and they’re getting the breaks now.

If the city had done revals every 10 years or so, no one would have an enormous tax bill on their hands now. Fighting the reval for 12 years is about 1/3 of the reason we’re in this position. The other 20 years that the reval didn’t happen is the rest of the cause for the big changes.

Our politicians need to do better.

I love the comment from the New Yorker, where she says I moved here because I thought I was onto a good thing and now its over I have to move. Sorry but you should have done your homework before moving none of this is a surprise it was all over news for the last 5 years. I just don’t understand how some of these people did not see this coming.

Look at your Mayor, he wasted millions stopping the reval when house prices were much lower and has given abatements to new developments like they were going out of fashion. I really believe the worst is yet to come as already been hinted these numbers were calculated on the current budget, what happens when all those rent abated buildings are full of people sucking up town funds with no taxes to pay for them…budget goes up as do taxes. The Mayor has already hinted at that, now the assessments are done the tax rate won’t be staying the same for long.