The New Jersey Bureau of Securities assessed a $450,000 penalty against a Jersey City man who defrauded investors through his website and online trading school, Acting Attorney General Matthew Platkin announced.

By John Heinis/Hudson County View

“The bureau’s actions send a strong message to businesses and individuals who think that they can disregard New Jersey’s securities laws,” Platkin said in a statement.

“We have a duty to protect investors around the state and we will continue to hold accountable those who try to operate under the radar by failing to register with the bureau and illegally selling unregistered securities.”

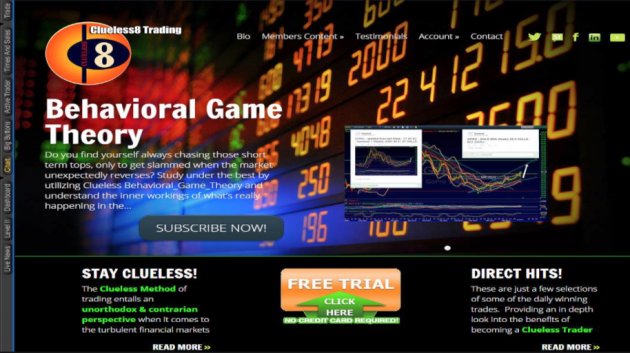

The bureau issued a civil summary penalty and cease and desist order against Fida Frank Rahman, also known as Frank Rahman, ClueLess8 Trading, and FAS Holdings, LLC for the offer and sale of $130,000 of unregistered securities, and misuse of investors’ funds.

They found that Rahman preyed upon aspiring investors by cultivating relationships with them through operation of his ClueLess8 website and online trading school, which sold memberships for information on different trading strategies.

Specifically, once gaining the trust of investors:

• Rahman solicited them to allow him to trade securities with their money

• Promised each investor that he would return their investment capital within one year, along with a substantial return on their investments and

• Illegally sold unregistered securities, acted as an agent without being registered, and engaged in other acts constituting securities fraud.

Additionally, the bureau found that, quickly after he received the investors’ funds, Rahman used much of the money to pay his personal expenses.

He placed the remainder of the investor funds in his own personal brokerage account and incurred substantial trading losses within weeks.

“Rahman lured investors with false statements and material omissions, and used their money to finance his personal expenses,” added Acting Director of the Division of Consumer Affairs Cari Fais.

“Our action today sends a message that those who financially prey on New Jersey investors face serious consequences.”

Rahman’s victims believed his experience as a former Wall Street trader of 14 years, as advertised on the ClueLess8 website, provided him with trading expertise and that he was using this expertise on their behalf.

“Rahman led investors to believe that his prior experience as a Wall Street trader would benefit them,” added Acting Bureau Chief Amy Kopleton.

“Only through vigorous enforcement of the securities law can the integrity of the financial services industry be ensured.”