Jersey City Mayor Steven Fulop announced that the tax reval will be moving forward, however, the breach of contract court case against a firm hired to do the reval in 2011 will be appealed.Â

By John Heinis/Hudson County View

“From the beginning, our position has been the same which is that we acknowledge the city needs a reval, but the reval process started by the previous administration would have resulted in unfair taxation due to the corrupt procurement process,†Fulop said in a statement.

“We attempted to recover dollars that were wrongly procured however, with the court’s initial decision yesterday; we will respect the comments and by starting the revaluation process we will eliminate the court’s view that the city’s sole interest is to delay the revaluation which was never the case.”

Fulop clarified that as the city begins drafting a request for proposals (RFP), they will also appeal the court’s decision “to pursue the dollars that were illegally spent.” A vendor is expected to be selected in the fall of this year.

Jersey City is one of 30 municipalities which has not done a revaluation in at least 25 years and is one of three municipalities that has been ordered by the state to complete the process by November 2017 (the other two being Elizabeth and Dunellen).

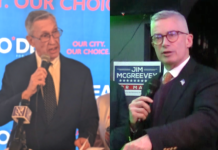

Fulop, an expected Democratic gubernatorial candidate for next year, and Republican Gov. Chris Christie’s office argued about the politics involved with the reval earlier this month.

Furthermore, at a Downtown Town Hall meeting in January, the mayor called a reval “catastrophic for you living in this city,” infamously stating that anyone arguing in favor of the reval is doing so “purely for hared for me.”

He was also heckled by 100s who attended the public launch of activist group Jersey City Together on Monday night for not giving a firm commitment on the reval.

The group then made a presentation to the city council on Wednesday night claiming a tax reval was about “justice.”

Through the same news release, Fulop defended appealing the court ruling made by Hudson County Superior Court Judge Francis Schultz, who decided that Reality Appraisal did not breach their contract.

In 2011, the Jerramiah Healy administration hired Realty Appraisal to conduct a citywide property tax revaluation.

The firm had “grossly low-bid their contract” and shortly after receiving the $3.2 million contract with Jersey City, hired the city’s former business administrator – “who had overseen the selection of the firm – something Mayor Healy signed off on.”

“The company then came back to amend the assessment formula to a method that is cheaper, however, untested by the state, to fit the low bid of the contract.”

Calling the changes “unorthodox and unethical,” Fulop’s office points out none of the measures went to the city council for approval, also noting that Realty Appraisal is embroiled in a nearly identical lawsuit in Wall, per The Asbury Park Press.

“Clearly, the process here was one that would have caused harm to the residents of Jersey City, which we sought to prevent,†Fulop also said in the same release.

“The state law for revaluations is fundamentally flawed and compounds the issues of gentrification by squeezing out long-term residents. This administration never has supported the idea of collateral damage with homeowners losing their homes in the name of social justice.”

The judge’s decision yesterday requires the city to pay Realty Appraisal $984,511 plus interest and attorney’s fees dating to October 2015. Prior to the Fulop administration halting the reval contract in 2013, the firm had already been paid $1.98 million – which the city will also seek to recoup during the appeal process.

Fulop also remarked that “the current structure of New Jersey revaluations feeds gentrification in neighborhoods,” reiterating his position that tax revals are not done fairly and equally throughout the state.

On that note, he says his administration has formed a working group to partner with state representatives to amend the state law to minimize the impact for long-term residents.

Christopher Santarelli, the deputy director of communications for the New Jersey Treasury Department, mostly brushed off the criticisms and said the Division of Taxation is pleased Fulop is going ahead with the reval.

“The Division of Taxation is pleased that Mayor Fulop has finally agreed to cooperate and join hundreds of other towns in complying with the law, which requires uniform taxation. We are hopeful that the other mayors also will abide by the State Constitution, which they swore an oath to uphold.â€